Fort Lauderdale, often called the “Venice of America” for its intricate network of canals, is a coastal city celebrated for its beaches, boating culture and vibrant nightlife. As the county seat of Broward County, the city has evolved from a spring break destination to a sophisticated hub of tourism, yachting, finance and technology. Fort Lauderdale’s economy also benefits from the Port Everglades cruise terminal, Fort Lauderdale–Hollywood International Airport and a booming marine industry. Home prices are among the highest in Florida, reflecting the city’s desirability and limited land. According to data from the 33308 ZIP code (encompassing parts of Fort Lauderdale), the median sold price of a home in June 2026 was $600,000 with a price per square foot of $400—up 12.1 % from the previous year. Inventory stood at 237 homes for sale, and the few sales recorded (7 homes) all sold below asking price. reports a median listing price of $599,000, a median sold price of $525,000, and indicates that homes sold 4.76 % below asking price on average, taking around 97 days to sell. The market is considered a buyer’s market.

With high home prices and a competitive environment, self‑employed residents of Fort Lauderdale—yacht brokers, lawyers, doctors, event planners, real estate agents, restaurateurs and digital entrepreneurs—often struggle to meet the documentation requirements of conventional mortgages. Bank statement loans offer a powerful alternative by allowing borrowers to qualify based on their cash deposits instead of tax returns. This article explores how bank statement loans work, why they are especially useful in Fort Lauderdale and why Select Home Loans is the leading lender for these products.

Understanding Bank Statement Loans

The Basics

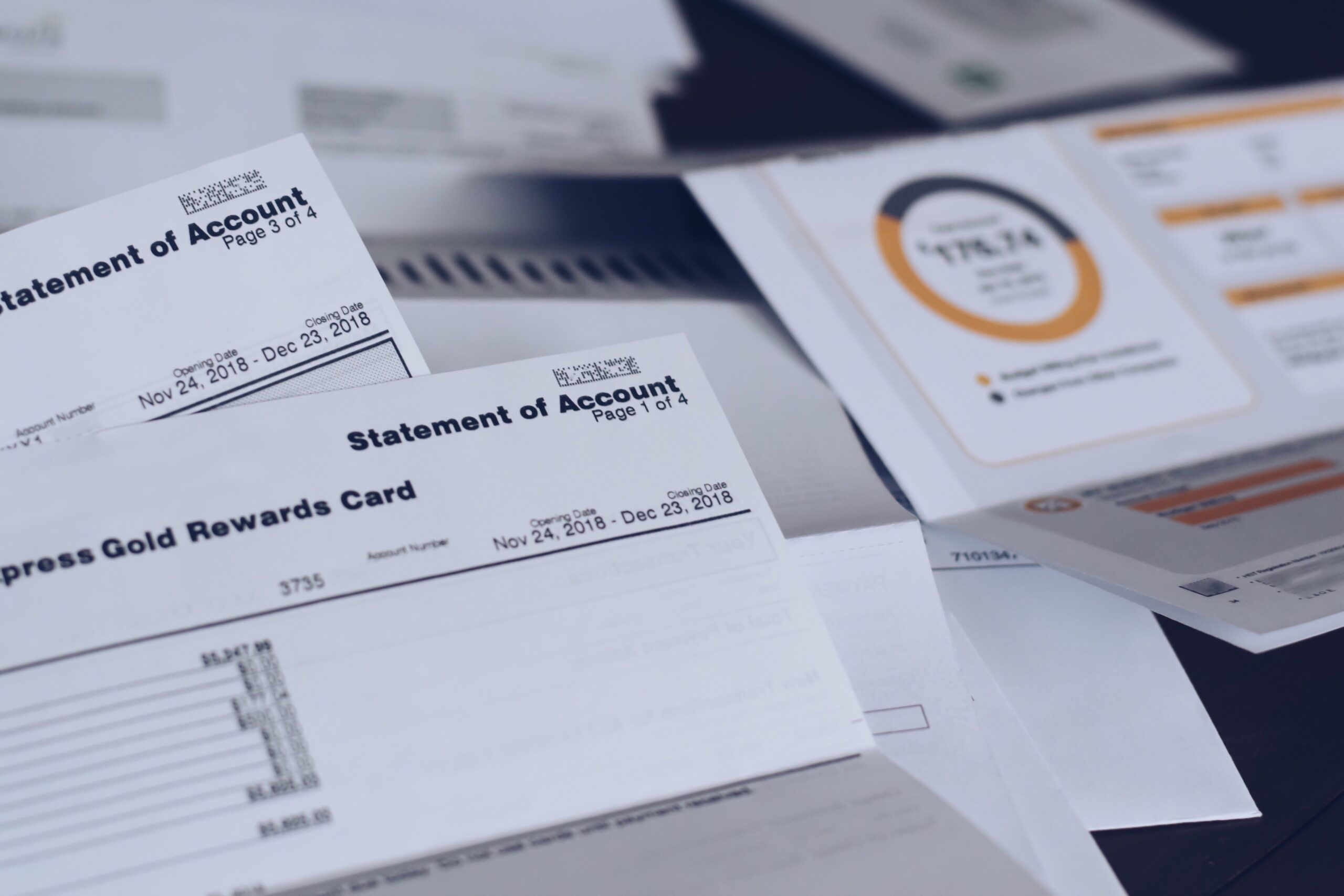

Bank statement loans are mortgage products designed for borrowers whose income is not easily verifiable through W‑2s or tax returns. Instead of requiring two years of tax filings, lenders evaluate 12 or 24 months of personal or business bank statements. They total the monthly deposits, apply an expense factor (often 50 %) to account for business costs and use the remainder as qualifying income. Borrowers must meet credit score and down payment requirements, but they can leverage their actual cash flow rather than taxable income.

Key Features

- Documentation: 12–24 months of bank statements; tax returns are generally not required.

- Credit Requirements: Minimum credit scores around 620. Borrowers with scores above 660 may qualify for down payments as low as 10 %.

- Down Payments and Reserves: Down payments typically range from 10–30 %, and lenders require two to six months of PITI reserves.

- Interest Rates: Rates are 0.5–1.5 % higher than those on conventional loans.

- Eligible Properties: Bank statement loans can fund primary residences, second homes, investment properties and jumbo loans.

Who Benefits?

These loans are ideal for:

- Small‑business owners and entrepreneurs in industries like hospitality, retail, tech, maritime services and real estate.

- Independent contractors such as yacht brokers, charter captains, attorneys, consultants and healthcare professionals.

- Gig workers and freelancers—photographers, event planners, musicians, social media influencers and marketing consultants.

- Real estate investors whose taxable income is reduced by depreciation and deductions.

Fort Lauderdale’s economy features many self‑employed professionals and business owners whose income varies seasonally or by contract. Bank statement loans recognize their cash flow, enabling them to finance property in this high‑cost market.

Fort Lauderdale Housing Market: Key Metrics and Context

Price Trends and Inventory

In June 2026, the median sold price in Fort Lauderdale’s 33308 ZIP code was $600,000, with a median price per square foot of $400, reflecting a 12.1 % year‑over‑year increase. Inventory in that area was 237 homes, and only 7 homes sold during the period; all of them sold below asking price. These small numbers highlight the limited supply and high price points typical of Fort Lauderdale’s coastal neighborhoods.

offers a broader perspective, reporting a median listing price of $599,000 and a median sold price of $525,000, with homes selling 4.76 % below asking price and spending 97 days on the market. The data indicates that Fort Lauderdale has transitioned into a buyer’s market, giving buyers more negotiation power after a decade of rapid appreciation.

Rental Demand and Investment Opportunities

Rents in Fort Lauderdale are among the highest in Florida. While statewide fair‑market rents average $1,601 for a two‑bedroom apartment and $2,112 for a three‑bedroom unit, Fort Lauderdale’s prime neighborhoods—Las Olas Isles, Victoria Park, Coral Ridge and Harbor Beach—command much higher rents. Two‑bedroom apartments often rent for $2,500–$3,500, while three‑bedroom homes can fetch $3,500–$5,000. Investors purchasing duplexes, triplexes or multifamily properties can achieve substantial cash flow. Bank statement loans allow them to qualify based on rental income and deposits, making it easier to buy these properties.

Economic Drivers and Self‑Employment

Fort Lauderdale’s economy is powered by tourism, marine services, healthcare, education and professional services. Port Everglades and the Fort Lauderdale–Hollywood International Airport make the city a global gateway, while the International Boat Show underscores its status as a yachting capital. Companies like AutoNation, Citrix Systems and Spirit Airlines contribute to the tech and corporate sectors. The city hosts numerous lawyers, doctors, luxury real estate agents, boat brokers and hospitality professionals. Many work as independent contractors or operate businesses with fluctuating income. Bank statement loans are ideal for these borrowers because they reflect actual cash flow rather than fluctuating taxable income.

Why Bank Statement Loans Are Ideal in Fort Lauderdale

High Property Values Require Flexible Underwriting

With median sold prices around $600,000, purchasing property in Fort Lauderdale often demands sizeable mortgages. Self‑employed borrowers may have high monthly deposits but low taxable income due to deductions. Bank statement loans enable them to qualify for larger loan amounts by considering gross deposits (minus expenses). For example, a yacht broker earning $25,000 per month in commissions but reporting only $80,000 taxable income could qualify for a million‑dollar property using a bank statement loan.

Buyer’s Market Advantage and Negotiation Power

The data shows that homes sell below asking price—4.76 % off on average—and spend around 97 days on the market. Buyers who can close quickly gain negotiating leverage. Bank statement loans, which bypass lengthy tax return verification, often close faster than conventional mortgages, allowing buyers to secure favorable prices or incentives.

Strong Rental Demand and Cash Flow

Fort Lauderdale’s luxury rentals, waterfront properties and vacation homes command premium rents. Investors purchasing duplexes or small apartment buildings can generate high monthly income, which bank statement loans consider during qualification. Because these loans assess rental income and deposits, investors can leverage them to acquire multiple properties.

Jumbo Loans for Waterfront and Luxury Homes

Fort Lauderdale’s waterfront properties—particularly along Las Olas, the Intracoastal Waterway and the beach—often exceed conventional loan limits. Bank statement loans can be structured as jumbo mortgages, enabling self‑employed borrowers to purchase high‑end homes based on their deposit history. This is valuable for entrepreneurs, physicians, entertainers and professional athletes who may have variable incomes.

Supporting a Diverse Professional Base

The city’s workforce includes attorneys, doctors, boat captains, digital entrepreneurs and hospitality managers. Many are self‑employed or work under contract. Bank statement loans give these individuals access to homeownership without penalizing them for taking business deductions or having inconsistent W‑2 income.

Loan Requirements, Terms and Considerations

Credit Score and Down Payment

Bank statement loans typically require a minimum credit score of 620. Borrowers with scores above 660 may qualify for down payments as low as 10 %, although many lenders require 15–30 %, especially for investment properties or jumbo loans. Higher credit scores and larger down payments often yield better interest rates.

Bank Statements and Expense Factors

Borrowers must provide 12–24 months of consecutive bank statements. Underwriters total monthly deposits and apply an expense factor—commonly 50 %—to estimate qualifying income. Keeping personal and business accounts separate and providing clear documentation for large deposits helps expedite approval.

Debt‑to‑Income Ratios and Reserves

Bank statement loans generally allow debt‑to‑income (DTI) ratios up to 45–50 %, recognizing the variability of self‑employed income. Lenders require two to six months of PITI reserves. Borrowers seeking jumbo loans or purchasing multiple properties should prepare for higher reserves.

Interest Rates and Fees

Interest rates for bank statement loans exceed conventional mortgage rates by 0.5–1.5 %. Mid‑2026 rates range from 7.5 % to 9.5 %. Closing costs include origination fees, underwriting fees and appraisal fees. Some loans impose prepayment penalties that decline over time. Borrowers should read terms carefully before committing.

Pros and Cons of Bank Statement Loans in Fort Lauderdale

Advantages

- Access for Self‑Employed Professionals: Bank statement loans allow borrowers to qualify based on deposits rather than taxable income.

- Higher Borrowing Capacity: Using gross deposits (minus expenses) often yields higher qualifying income.

- Speedy Closings: Without the need to verify tax returns, bank statement loans can close quickly, giving buyers an edge in negotiations.

- Versatility: These loans can finance luxury homes, primary residences, investment properties and jumbo loans.

- Ability to Leverage High Rents: Investors can purchase multi‑unit properties and rely on rental income to qualify.

Drawbacks

- Higher Interest Rates: Rates are higher than conventional loans, increasing monthly payments.

- Larger Down Payments: Borrowers typically need 10–30 % down, especially for luxury or investment properties.

- Reserve Requirements: Lenders require substantial reserves—two to six months of mortgage payments.

- Detailed Deposit Scrutiny: Underwriters may question large or irregular deposits and require additional documentation.

- Limited Lender Availability: Fewer lenders offer bank statement loans; borrowers must work with specialized lenders.

Real‑World Example: A Luxury Realtor Buys a Waterfront Condo

“Vanessa,” a luxury real estate agent in Fort Lauderdale, earns commission income that fluctuates widely. Over the past two years, she has averaged $35,000 in monthly deposits, although her taxable income is only $90,000 after deductions for marketing, travel and staging expenses. Vanessa wants to purchase a $900,000 waterfront condo in Coral Ridge. She plans to live there but eventually rent it seasonally.

Vanessa contacts Select Home Loans. She provides 24 months of business bank statements showing average deposits of $35,000. The underwriter applies a 50 % expense factor, yielding a qualifying income of $17,500 per month. Vanessa has a 700 credit score and puts 25 % down ($225,000). Her 30‑year fixed rate is 7.5 %, resulting in a principal and interest payment of about $4,725. HOA fees, insurance and property taxes bring her total payment to around $5,600. Comparable waterfront rentals exceed $6,500 per month during peak season. Select Home Loans closes her loan in five weeks, enabling her to acquire a dream property. Without a bank statement loan, Vanessa would struggle to qualify due to her fluctuating commission income.

Tips for Streamlining Your Bank Statement Loan Application

- Maintain Clear and Separate Accounts: Keep personal and business accounts separate to simplify underwriting. Avoid co‑mingling funds.

- Document Deposits: Provide invoices, receipts or contracts to verify large deposits. Unexplained deposits may trigger additional scrutiny.

- Monitor and Improve Credit: Pay bills on time, reduce balances and avoid new debt. Scores above 660 can secure better terms.

- Save for Reserves: Aim for at least three to six months of mortgage payments saved in liquid assets.

- Work with an Experienced Lender: Choose a lender specializing in bank statement loans who understands Fort Lauderdale’s market, such as Select Home Loans.

Why Select Home Loans Is Fort Lauderdale’s Preferred Bank Statement Lender

Website: SelectHomeLoans.com

Phone: 888-550-3296

Local Expertise

Select Home Loans is a Florida‑based mortgage company with deep knowledge of Fort Lauderdale’s neighborhoods, property values and insurance requirements (including flood and windstorm policies). Their loan officers understand the unique dynamics of the local market—such as HOA fees, condo association rules and property taxes—which is crucial when underwriting high‑value properties.

Specialized Bank Statement Programs

Select Home Loans offers multiple programs for 12‑month and 24‑month bank statements. They can evaluate personal or business accounts and structure loans for primary residences, second homes, investment properties and jumbo loans. Borrowers can choose fixed or adjustable rates and interest‑only options.

Fast and Transparent Closings

Because they focus on non‑traditional loans, Select Home Loans streamlines the underwriting process, often closing bank statement loans within three to five weeks. Their transparent communication ensures that borrowers understand rates, fees, reserve requirements and potential prepayment penalties.

Commitment to Self‑Employed Professionals

Select Home Loans was founded to serve self‑employed borrowers. Their underwriters understand commission‑based, seasonal and contract income and apply realistic expense factors. They also guide clients on preparing bank statements and building reserves.

Personalized Service

From pre‑qualification to closing, Select Home Loans offers personalized support. They help borrowers gather documentation, choose the right loan program and navigate appraisals and inspections. Borrowers appreciate the company’s responsiveness and local insight.

Conclusion and Next Steps

Fort Lauderdale’s high property values, strong rental demand and buyer’s market conditions create both opportunities and challenges for self‑employed buyers. Bank statement loans provide a solution by allowing entrepreneurs, professionals and investors to qualify based on their actual cash flow instead of taxable income. Whether you’re purchasing a waterfront condo, a duplex in Victoria Park or a luxury estate along Las Olas, these loans can open doors that traditional mortgages may leave closed.

Select Home Loans stands out as Fort Lauderdale’s top lender for bank statement loans. With local expertise, flexible programs, fast processing and a commitment to self‑employed clients, they can help you achieve your real estate goals. If you’re ready to buy or invest in Fort Lauderdale, contact Select Home Loans today to explore your options and secure a customized bank statement loan.

Disclaimer: The information in this article reflects mid‑2026 market conditions and lending guidelines. For personalized advice, consult a licensed mortgage professional and financial advisor.

![Best DSCR Lenders in Maryland (Rental Property Loans) [2026 Guide]](https://www.selecthomeloans.com/wp-content/uploads/2026/09/cropped-image-pay-home-insurance-professional-fema-2026-02-18-05-56-08-utc-600x403.jpg)